Who We Are

We’re just what you’d expect in a financial institution and more than you ever imagined.

For 70 years, we’ve focused our attention on providing members with the best financial solutions possible. Our thoughtful, caring approach has helped thousands of individuals step closer to their dreams.

Today, County Federal remains steadfast in our commitment to county, city and school employees and the affiliated organizations that support them. We provide this family of organizations — which forms the foundation for our membership — with exceptional service based on a philosophy we call the County Federal Experience.

It sums up our most important priorities and revolves around four main principles: a Warm Welcome, a Knowledgeable Solution, a Passionate Commitment and Building Relationships for Life.

Through our continued support of this family of organizations, County Federal has been able to develop various outreach programs to benefit those in our community. We have helped many young members reach their educational goals through our scholarship program. We also dedicate time and money to various non-profit organizations within our field of membership. At County Federal, you’ll know right away that you aren’t just a customer, you’re a member. And that means preferred rates, a comprehensive line of products and services — and the kind of personal service that builds Relationships for Life.

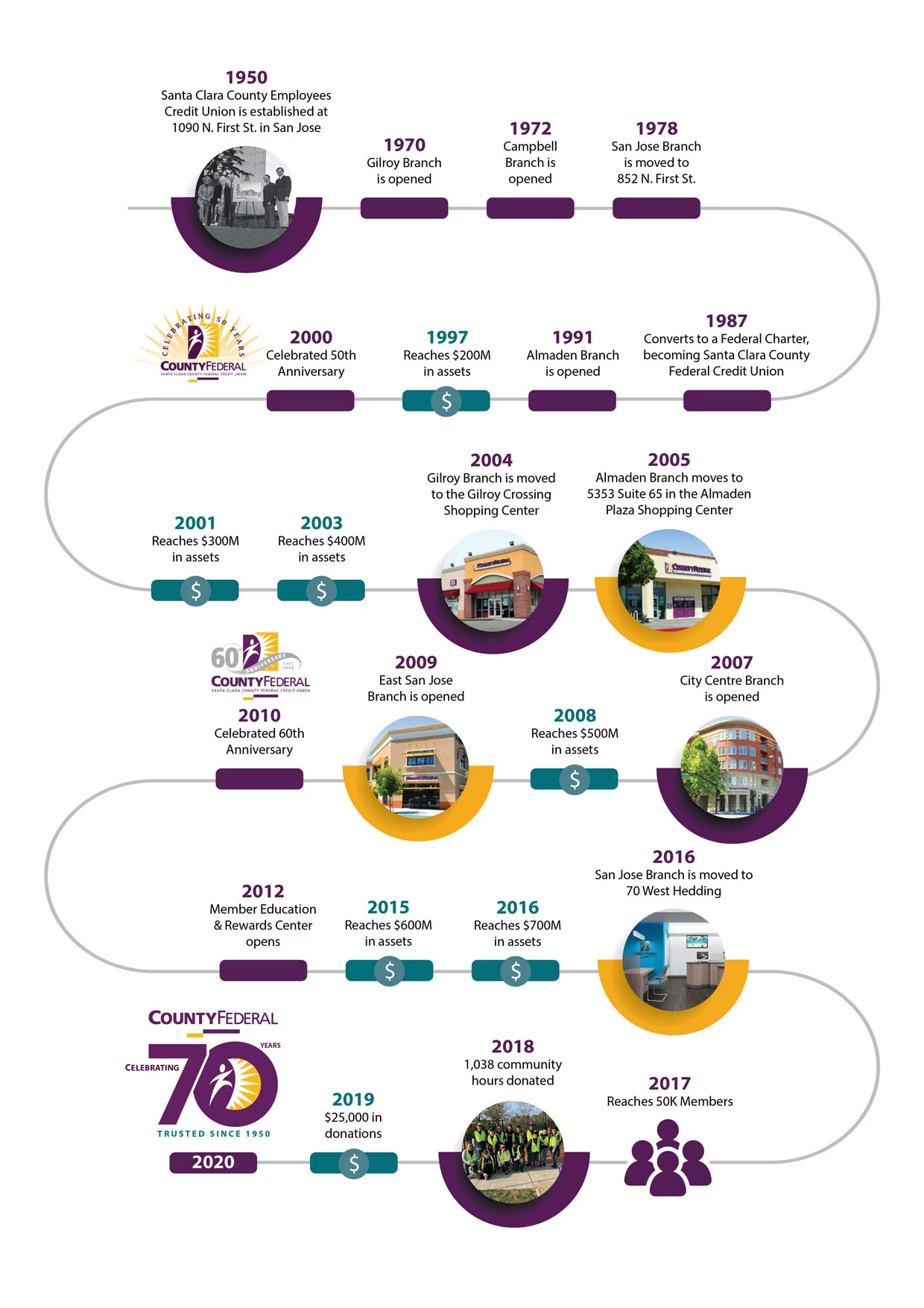

Our History

Management

Board of Directors

Traci Hess – Chair

Jose Luis H. Pacheco – Vice-Chair

David Indra – Secretary

Dave Cameron – Treasurer

Deborah Baker – Director

Juan Ledesma – Director

Peter Ng – Director

Supervisory Committee

John Tran – Chair

Elizabeth Trigos-Salinas – Vice Chair

Katelyn Lu - Secretary

Mary Fisher - Member

Shawn Whiteman - Member

David Indra – Board Liaison

Executive Leadership

Rebecca Reynolds Lytle – President & Chief Executive Officer

Joseph Bonacci – Senior Vice President & Chief Information Officer

Divine David – Senior Vice President & Chief Experience Officer

Simran Gyani – Senior Vice President & Chief Brand Officer

Trent McIlhaney – Senior Vice President & Chief Financial Officer

Jennifer Montero – Senior Vice President & Chief Human Resources Officer

Senior Leadership

Joni Barnes – Vice President of Lending Experience

Teresa Caseras - Vice President of Brand & Marketing

Margaret Czyz – Vice President of Accounting & Finance

Marco Denson – Vice President of Core Systems

Linda Elrod – Vice President of IT Digital Delivery & Enterprise Project Management

Richa Gera – Vice President of Human Resources

Bebe Souvannavong - Vice President of Learning & Development

Jaime Vasquez – Vice President of Infrastructure & Security

John Wu – Vice President of Member Experience

Financial Statement

As of May 31, 2024

Assets . . . . . $953,072,028

Loans . . . . . .$505,893,603

Shares . . . . . $878,448,752

Members . . . . . . . . .47,543